My Story

This article was published as a guest article in freefincal.com on March 22, 2018 – Fee-only advisor journey: Swapnil Kendhe’s successful transition into a SEBI RIA

“Past events always look less random than they were. I would listen to someone’s discussion of his own past realizing that much of what he was saying was just a backfit explanation concocted ex post by his deluded mind.” -Nassim Taleb in the preface of his book Fooled by Randomness.

While the temptation is always there to present a better-looking picture of your own past (based on your memory of the past, which is slightly different from what you experienced in reality), I have tried to tell my story like it is.

I have no formal education in personal finance and investing (I did PGDBA Finance after SEBI made post-graduation mandatory for RIAs in 2020). I accidentally landed in this profession, which luckily suited me. What follows is majorly the story of how I learned personal finance starting as an insurance agent.

I am a Chemical Technologist by education. I worked with Marico Ltd. and Hindustan Unilever Ltd. as a production executive for 3 years. In 2011, I left the job to do something of my own and started a business. Business did not work as expected and I had to close it within a year. This left me in debt and with no cash flow.

In mid-2012, when I had nothing else to do, I applied for the LIC agency on a friend’s suggestion. I wanted a temporary source of income until I found something worthwhile to do. But things changed during 10 days of mandatory training before the IRDA exam. I heard stories of successful insurance agents and the huge income they earn. Incidentally, one of India’s Biggest Insurance Agents Bharat Parekh, has an office in the same building I attended this training in. This changed my perception of the profession of insurance selling and I decided to take it seriously.

I got my LIC licence in Aug 2012. I began attending agent training, purchased LIC agent software, and spent days studying plans and plan combinations. Like all LIC agents, I also believed that there is no better investment option than LIC.

At around the same time, someone suggested that if I am selling insurance, why sell products of one company when it is possible to sell any insurance company’s product through insurance brokers like Bajaj Capital. So I empanelled with Bajaj Capital in Sep 2012 and began selling all types of insurances through them. In health insurance, I used to sell Apollo Munich and Max Bupa policies.

Company Fixed Deposits could also be sold through Bajaj Capital, but I never sold them. Quite a few Company Fixed Deposits sold by Bajaj Capital like Plethico Pharma, Elder Pharma, Bilcare, Unitech, Jaiprakash Associates, Omnitech, Micro Technologies have defaulted. I was lucky not to have touched them.

I also took Oriental agency specifically to sell ‘Oriental Happy Family Floater’. This product used to be the cheapest health insurance product especially if older members of the family were covered in a family floater policy. There was a flaw in the design of this product and oriental subsequently corrected it.

Barring few close friends, I did not approach friends, relatives and acquaintances to sell insurance since it was embarrassing for me to be seen selling insurance after leaving a good job at HUL. I acquired almost all my early clients through cold calling and subsequent clients through references. I have not asked for references myself from any of my clients all these years. I am too proud to do that (not sure if it is a virtue or vice).

This was a terrible way to sell insurance. My commission in those early days would not even cover EMI of the personal loans I had taken for my sister’s marriage and renovation of our ancestral house.

One fine day I stumbled upon Jagoinvestor.com and it opened a real world of personal finance for me. I learned about the inferiority of traditional insurance products for the first time on Jagoinvestor. I also discovered subramoney.com in one of the reader comments there.

Subramoney was a treasure trove of personal finance wisdom. It was addictive. For the next few days, I was reading Subramoney leaving everything else. It transformed me from an average insurance agent to a decent adviser within a few days. I have been a regular reader of Subramoney since I discovered it in 2013. I read all Subramoney articles published from 2008. I wanted to see what Subramoney had to say when the 2008 market crash was actually happening. I started with the first article published in 2008 and kept reading subsequent articles. By the time I stopped, I had reached the end of 2011.

I became a Mutual Fund distributor in mid-2013. I was a regular reader of Jagoinvestor.com during this period. There was this man Ashalanshu all over Jagoinvestor at that time. He used to comment on almost every query. In the 2nd half of 2013, Ashalanshu’s activity began going down on Jagoinvestor. When I asked him about it in one of my comments, he replied he was busy with his own Facebook group. I asked if I could join his group and he added me to Asan Ideas for Wealth(AIFW).

AIFW in those days was amazing. I had already discovered freefincal.com by then and was using freefincal calculators. Pattabiraman Murari of freefincal.com was active on AIFW and so was P.V. Subramanyam of subramoney.com. Some quality DIY (Do It Yourself) investors, as well as many well established financial advisers, were equally active in the group. My reading and learning of personal finance and investing had already picked up speed by the time I landed on AIFW. But it was mostly through books and blogs. AIFW added the much-needed human element to it.

My participation in AIFW discussions was totally devoid of political correctness. It irked few people but also attracted the attention of the right kind of people like Pattabiraman Murari and Ashal Jauhari (I was less aware of my ignorance that time and therefore would post, comment and take part in discussions more often).

Sometime at the end of 2013, Pattabiraman Murari shared with me Canada-based financial adviser Jim Otar’s book “Unveiling the retirement myth”. This book has influenced the way I look at financial planning more than anything else. I learned to look at financial planning in terms of lucky and unlucky outcomes because of this book. It also made me aware of the sequence of return risk, which is one of the most important factors to be considered while doing financial planning.

I discovered Nassim Taleb on Subramoney. Since I did not have spare money to buy books in those days, my reading was restricted to free e-books I could download from the internet (all my income would go towards loan EMIs and paying off debt I had incurred because of my failed business).

Reading Taleb was like getting trained in inference. Taleb made me sceptical of all self-proclaimed experts (investing is all about the future and those we call experts are as clueless about the future as we are). He made me doubt the quality of my own knowledge too. I began understanding the role luck plays in investment performance. My understanding of risk also became better with Taleb.

Reading, studying and exploring personal finance and investing had become the principal activity of my life by this time. Subramoney.com has a list of 57 must-read investment books. I have most of these books in my personal library of more than 100 investment and related books. I have read most of these books, partially read some and reread a few many times. Reading a book or blog is like entering a room. It opens doors to other rooms. I have a habit of opening every door I see and checking the adjacent room. Poor Charlie’s Almanack is one room I never get tired of spending time in. Charlie Munger’s approach of “trying to be consistently not stupid instead of trying to be very intelligent” better suits my temperament. This is also the way I like to handle financial planning.

Twitter has also been a significant source of learning for me. Whenever I discover some quality handle like @contrarianEPS, I usually read all the past tweets, check other handles it follows and add good handles to different lists I maintain on twitter. Twitter has also become my primary source of news since I do not read newspapers and watch TV.

In my early days in this profession, I wanted to do CFP (Certified Financial Planner) but the cost of CFP was too high for me at that time. By the time I came into a position to afford it, I had already explored quite a bit of personal finance. I had also seen many advisers flaunting their CFPs, whose understanding of personal finance I was not impressed with. If CFP and other such certifications (textbook learning to pass exams) would not make me a better adviser, then acquiring them only for image building to attract more business was unethical. By the same token, SEBI RIA is one more decoration that tells nothing about the competence of an adviser.

I stopped selling LIC policies shortly after landing on AIFW which led to the termination of my LIC agency. I also transferred my health insurance business to one senior health insurance agent in Nagpur who deals only in health insurance. I did not have the experience of handling claims and this agent could better serve my clients. I also wanted to get out of insurance completely because mutual funds would excite me more than insurance. This gave me more time to explore personal finance and investing.

I was a member of AIFW when SEBI came up with RIA (Registered Investment Advisor) regulation in 2013. There used to be animated discussions in AIFW about this regulation. Initially, I was on the side of the adviser community ridiculing the Fee-Only model, but slowly I realised that this is a far superior model from the point of view of investors.

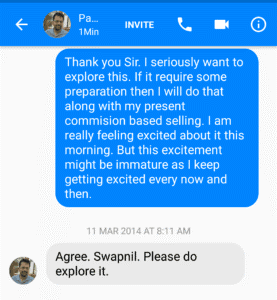

This was my message to Pattabiraman Murari dated March 11, 2014, by which time, I had begun thinking seriously about moving to the fee-only model. Since I did not have the post-graduate degree in finance, I needed to fulfil 5-year minimum experience criteria to apply for RIA registration, which was still three and half years away. I decided to use this time to build my competence as a financial adviser.

This was also the time when I began staying away from the IFA (Independent Financial Adviser) community. Most IFAs have a tendency to think in terms of Mutual Fund AUM, size of SIP book, number of clients and commission. Rarely have I come across an IFA who works as much on sharpening his knowledge of investing as he does on increasing his income. This is the obvious outcome of a system that appreciates and pays to do more, not better.

Prospects of earning a higher income somehow does not excite me (This has something to do with my constitution, I guess. I wanted to join Ramakrishna Mission when I was in college and even when I was doing a job). I had no appetite for doing 3-5 client/prospect meetings every day either (I am lazy when it comes to doing non-intellectual work). I also have an inability to offer my clients one option when I am aware that a better option is available for them. I struggled with not talking about direct plans of mutual funds for a long time and stopped putting my clients’ money in regular plans even before becoming an RIA. I was a misfit in the IFA community where nobody believed in a fee-only model. My reclusion from the IFA community helped me in keeping my thinking clean and maintaining my conviction in the fee-only model.

I do not want to take the moral high ground here for my decision to move to the fee-only model because it was also a rational decision for me to take. AUM gathering (selling) was a game I had little aptitude for and even if I had tried, I could not have become a top IFA; but I can definitely make a name for myself as an RIA.

In mid-2016, one of my clients asked me to recommend a few good stocks for his stock portfolio. I was not comfortable doing this but when he kept insisting; I asked him for a couple of month’s time to study. For the next 3 months, I explored direct equity, leaving everything else. I kept doing the same for 3 more months after giving my recommendations. In early 2017, I had to take responsibility for the stock portfolio of one more of my clients against my will. Once again, I spent all my time doing direct equity research. I was also handling my brother-in-law’s stock portfolio during this time and the equity portion of my personal portfolio was also totally invested in stocks. Being a bull market, all these portfolios did well. This consumed more than 80% of my time for close to a year. Though I earned nothing for all this work, it further increased my understanding of equity as an asset class.

My father had helped me close my personal loans and part of the debt from his retirement proceeds at the end of 2015, but I still had some money to be returned to a couple of my close friends. In the 2nd half of 2017, I sold my stock portfolio to clear all my debts and to construct my office at home. After selling my own stock portfolio, I noticed I had lost the intensity with which I was doing stock research earlier. I was also about to submit my RIA application and I knew I would not get enough time to do justice to direct equity advice. I did not think that I had enough knowledge, competence and experience enough to advise on direct equity either.

So I sold the direct equity portfolio of my brother-in-law I was handling. My first direct equity client had already sold his portfolio for his house construction. I approached the other client and told him I will not be able to take responsibility for his direct equity portfolio. I suggested that he either sell his stock portfolio and invest the amount in a mutual fund or take the advice of some competent adviser who can take responsibility for his stock portfolio. This got him angry, but he did as suggested. He was in good profit and since I had not charged him anything, there was no obligation on my part.

I cleared mandatory exams for SEBI RIA registration in Feb-2017 and applied for registration after my 5-year minimum experience criteria got fulfilled in Aug 2017. I got my registration on Oct 31, 2017.

I had not yet received my registration when I attended the first meeting of Fee Only India (FOI) in Sept 2017. A month before this meeting, I had spent a day with Melvin Joseph of finvin.in when he had come to Nagpur to deliver a guest lecture in one MBA college. Melvin Joseph was the first man I met from the adviser community I felt completely at ease with. I have always found it difficult to speak my mind with most people in this profession. Either they find me over smart or impractical (some call me plain stupid). With Melvin Joseph, I didn’t have to dilute my talk. He was also willing to share everything with advisers, ready to work on a clean fee-only model.

I had a similar experience with other members of FOI. It feels like family in FOI. Ashal Jauhari and Pattabiraman Murari are like the binding force for the group. I also cherish the privilege of discussing difficult financial planning cases with Ashal Jauhari and intellectual stuff with Pattabiraman Murari.

This is one profession where experience does count. I have tried to compensate for my lack of experience by spending the majority of my time studying and exploring personal finance and investing in the last 5 and half years, but I only had as much time. There are still many things I need to learn to fluency as a financial adviser. I have also realised that I cannot become expert at everything.

I do not want to work as an adviser in an area where my knowledge is superficial. Financial planning of resident Indians and NRIs who do the majority of their investments in India falls within my circle of competence and I want to stick to it for now. I do not want to handle US and Canada clients since I do not have enough grasp of applicable taxation and investment options available for them. I no longer provide stock recommendations either.

My wife resigned from her job (as we had decided) the very next day I got my registration and was relieved from the job in the 2nd week of Dec 2017. She was a teacher in one private school in Nagpur. We are a two-member team now.

It is a popular opinion within the adviser community that the fee-only model doesn’t work in India but this model better suits my temperament and it is working fine for me.

In June 2020, Pattabiraman Murari of freefincal.com asked me to write another article describing my journey as a fee-only financial planner till then. Here is a link to that article – Becoming a competent & effective financial advisor. My journey so far

In Feb 2019, my interview was published in Morningstar.in. Here is a link to the interview – LIC agent turned fee-only RIA